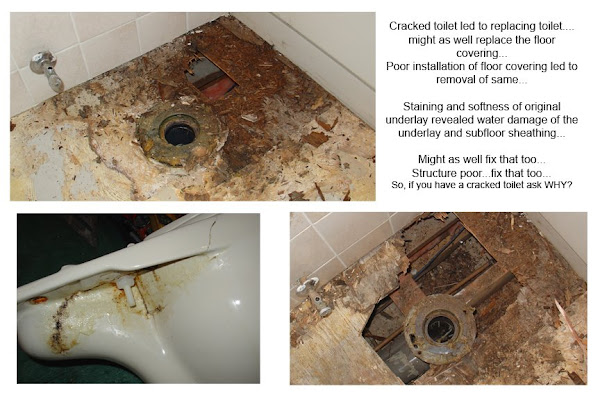

I always recommend that homeowners TURN OFF THE WATER when leaving the house for extended periods. A toilet that breaks can flood the house for example.

During extreme cold where there is a risk of the water supply freezing (such as happened in Toronto this past winter), leaving a cold water tap open enough to allow the water to flow constantly may prevent freezing. The cost in water is much lower than having your pipe thawed or repaired due to expansion splits.

I DO HOUSE CHECKS so please call me if you need your property monitored while gone for extended periods.

UPDATE UPDATE UPDATE www.cbc.ca/news/gopublic

JUNE 17/15 - CBC radio's GO PUBLIC published a story regarding a Waterloo, Ontario, couple's dilemma with their insurance company which refused to cover flooding from a sprinkler system which burst while they were on vacation. They had turned off the water but left the sprinkler system active in accordance with city/fire codes. Makes sense to leave that on in case of fire but who could predict the system would freeze? The insurance company refused their claim and it's now before the courts.

Another example of how insurance companies find ways to deny claims and one more reason to check carefully the full policy and get in writing any EXCLUSIONS so as to be on the same page regarding what's covered and what's not.

No comments:

Post a Comment